When it comes to safeguarding your wealth, few strategies are as time-tested as investing in precious metals. With economic uncertainties and inflation always looming in the background, gold and silver remain trusted hedges for long-term security. If you’ve started your research, you’ve probably come across two major players: Augusta Precious Metals and Birch Gold Group. But how do they compare, and which might be right for you?

Whether you’re new to gold IRAs or you’re looking to diversify your existing portfolio, this comparison will help you confidently choose the partner that aligns with your financial goals.

Why Precious Metals?

Before we dive into the comparison, it’s important to revisit why you’re considering gold or silver in the first place.

Precious metals offer:

- Inflation protection

- Portfolio diversification

- Tangible value

- Security in volatile markets

Unlike stocks or crypto, gold has stood the test of time—through recessions, political turmoil, and currency devaluation.

Ready to learn how top gold IRA companies help you make the most of your investment? Keep reading.

Company Overviews

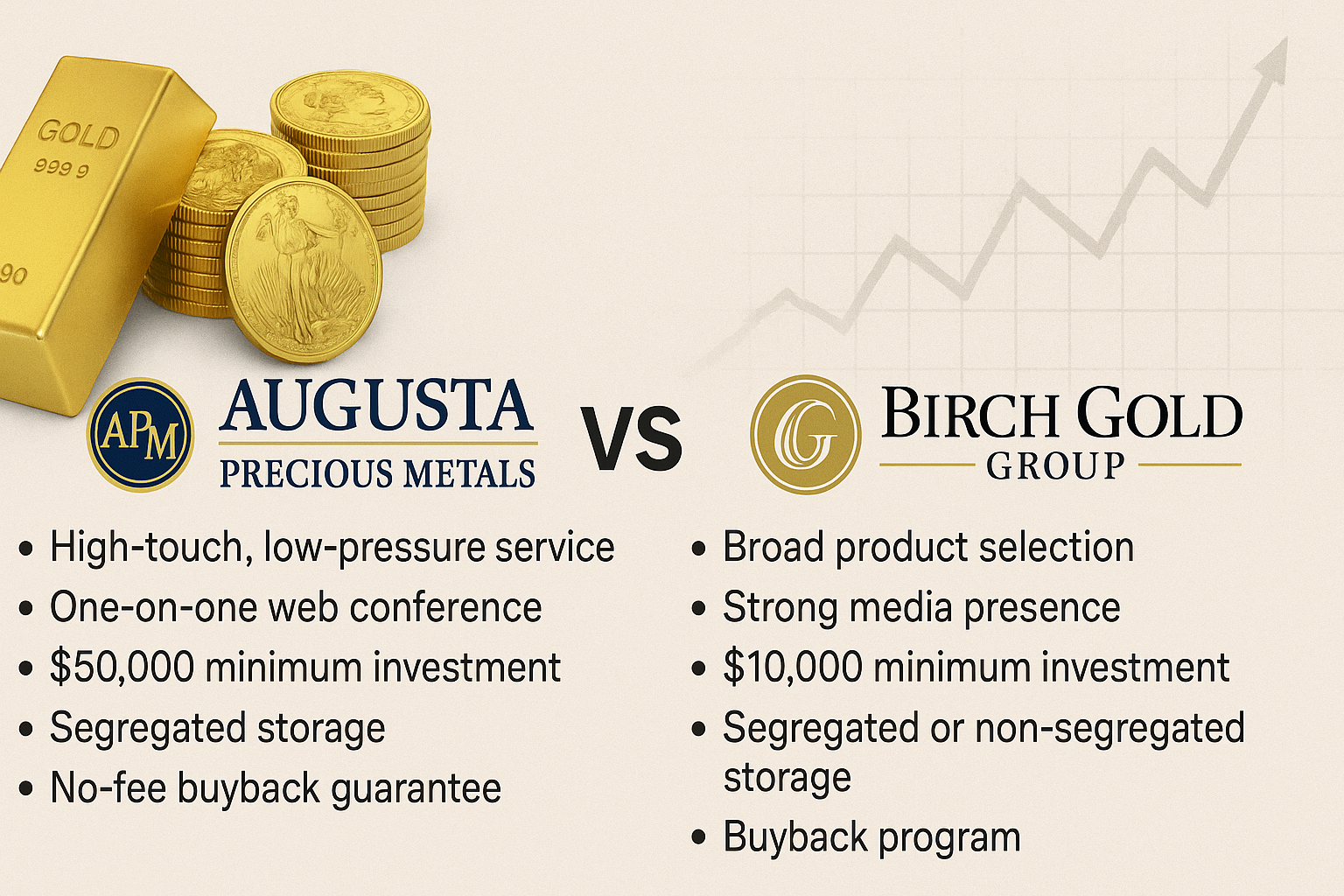

Augusta Precious Metals

Founded in 2012 and based in Beverly Hills, California, Augusta Precious Metals has built a reputation around education and transparency. The company focuses on helping retirees and conservative investors set up gold and silver IRAs, offering a concierge-style service that’s rare in the industry.

Their most notable feature? A one-on-one web conference with a Harvard-trained economist who helps explain the ins and outs of the precious metals market. This level of education is a major selling point for those who are still on the fence.

📌 Want to see if Augusta’s educational approach is right for you? Consider scheduling a free info session on their website.

Birch Gold Group

Established in 2003, Birch Gold Group is one of the most well-known names in the precious metals space. Based in Burbank, California, Birch offers a wide variety of physical bullion (gold, silver, platinum, and palladium) and specializes in precious metal IRAs.

The company is often recognized for its media presence, frequently featured on financial shows and partnered with high-profile figures like Ben Shapiro.

While Birch may not offer the same white-glove service as Augusta, they do offer more product diversity and a well-rounded educational library to support your buying decisions.

Customer Experience

Augusta: High-Touch, Low-Pressure

One of the standout features of Augusta is their commitment to education without pressure. Their onboarding process is carefully designed to inform rather than to push.

You’ll be assigned a dedicated account manager who walks you through every step of the gold IRA process, including working directly with your IRA custodian and handling the paperwork for you.

✅ Pros:

- Educational webinars and personal consultations

- Lifetime support

- Transparent pricing with no hidden fees

⛔ Cons:

- $50,000 minimum investment

- Limited selection of metals compared to competitors

Birch: Broad Reach, Strong Reputation

Birch Gold Group takes a balanced approach to customer service. They provide personal representatives but also empower you to research independently through a strong resource hub.

Clients report that the Birch team is knowledgeable and professional, but there have been occasional reviews noting upselling tactics, which can be off-putting for some investors.

✅ Pros:

- Lower minimum investment ($10,000)

- Broader selection of metals

- Strong media presence and trust

⛔ Cons:

- Customer service can be inconsistent

- Some reports of sales pressure

IRA Setup & Fees

Augusta Precious Metals

Augusta partners with Equity Trust as their preferred IRA custodian. The setup process is smooth and highly guided.

Fee Summary:

- $50 account setup

- $100 annual custodian fee

- $100 annual storage fee (segregated storage)

Importantly, Augusta is known for having no hidden fees or recurring commissions, which means you know exactly what you’re paying for.

💡 If you’re an investor who values transparency and premium service, Augusta might be the safer bet—especially if you’re working with a larger retirement account.

Birch Gold Group

Birch works with multiple custodians, including Delaware Depository and Brink’s Global Services, offering some flexibility based on your preferences.

Fee Summary:

- $50 account setup

- $80 annual maintenance

- $100 annual storage (segregated or non-segregated available)

While their fee structure is comparable to Augusta’s, Birch occasionally offers promotions to waive fees for the first year, which could benefit newer investors starting small.

Precious Metal Offerings

| Metal | Augusta Precious Metals | Birch Gold Group |

|---|---|---|

| Gold Bullion | ✅ | ✅ |

| Silver Bullion | ✅ | ✅ |

| Platinum | ❌ | ✅ |

| Palladium | ❌ | ✅ |

If you’re only looking to invest in gold or silver, either company will serve you well. However, if platinum and palladium are of interest to you, Birch is the clear winner.

🛒 Looking for a broader range of metals? Visit Birch Gold’s website and explore their complete product line.

Storage & Security

Both Augusta and Birch offer segregated storage options (meaning your metals are not co-mingled with other investors) and are partnered with reputable facilities.

- Augusta uses the Delaware Depository, with $1 billion in all-risk insurance through Lloyd’s of London.

- Birch provides access to multiple depositories including Brinks and Delaware, giving you a bit more control over your storage preference.

Education & Support

Augusta’s Educational Experience

Augusta leans heavily into financial education, and it’s more than just a sales tactic. Their materials are straightforward, beginner-friendly, and built to empower you to make informed decisions.

They also offer a one-on-one web conference with Devlyn Steele, their director of education and a Harvard-trained economist. This is one of the most robust educational programs in the gold IRA industry.

📚 If you’re new to investing and want to understand the ‘why’ behind the move to precious metals, Augusta provides that foundational knowledge.

Birch’s DIY Learning Library

Birch Gold doesn’t hold your hand quite as much, but they offer a well-organized knowledge center, complete with:

- Market updates

- Retirement planning guides

- Metals 101 content

This DIY approach is perfect for more independent investors who prefer to self-educate and make decisions at their own pace.

Buybacks & Liquidity

Both companies offer buyback programs, but Augusta shines with its no-fee buyback guarantee—a standout perk if you’re concerned about liquidity.

Birch also offers a buyback program, though they reserve the right to evaluate rates based on market conditions.

💬 Pro tip: If liquidity and flexibility are priorities, make sure you discuss buyback terms during your consultation.

Trust, Ratings & Reputation

| Metric | Augusta Precious Metals | Birch Gold Group |

|---|---|---|

| Better Business Bureau | A+ | A+ |

| TrustLink Reviews | 5/5 (1,000+ reviews) | 4.9/5 (1,000+ reviews) |

| Consumer Affairs | 5/5 | 4.8/5 |

Both companies maintain exceptional reputations in the industry. Augusta’s reviews often mention outstanding customer service and no-pressure education, while Birch’s highlight knowledgeable reps and product variety.

Which Should You Choose?

It ultimately comes down to your investment goals, your comfort level with independent research, and how much hand-holding you want through the IRA process.

Choose Augusta Precious Metals if:

- You value white-glove service

- You want personalized education

- You have $50,000 or more to invest

- Transparency and low-pressure sales matter to you

📞 Think Augusta is the right fit? Reach out for a free consultation and educational session today.

Choose Birch Gold Group if:

- You’re comfortable with DIY learning

- You want access to platinum and palladium

- You prefer lower minimum investment thresholds

- A strong media presence adds to your trust

📦 Curious about Birch Gold’s diverse product offerings? Request a free investor kit to get started.

Final Thoughts

When comparing Augusta Precious Metals vs Birch Gold, the right answer depends on your investment style.

- Augusta is ideal for high-net-worth individuals who want top-tier service and support.

- Birch is great for investors who value choice, independence, and accessibility.

Whichever path you choose, you’re taking an important step toward securing your financial future with tangible, time-tested assets. Take the next step by scheduling a call, downloading a free info kit, or just asking questions. Your golden future could be just a click away.